We Need to Be Angrier About State Taxes Than We Are

Progressives Tend to Focus Tax Fairness Debates at the Federal Level - but Tax Inequity in the States Poisons the Whole Debate on Tax and Spending Decisions

When progressives talk about tax policy, most talk about federal policy and the unfairness of tax cuts for the wealthy. But when voters are surveyed, as Gallup did in 2023, a strong majority (55%) cite state and local taxes as the biggest source of tax unfairness, rather than complaining about federal tax issues. 29% of those surveyed pick local property taxes as the most unfair tax they face. Other recent polls in Texas, Idaho, Iowa, and New York among others show massive concern with the high property taxes in each state, especially as the recent runup in housing prices drives higher tax payments.

They aren’t wrong to have that view, largely because progressives have done a pretty good job in the last forty years fighting for tax equity at the federal level - while, as I argue below, doing a pretty crappy job improving the issue at the state level.

Progressives Have Been Pretty Successful on Federal Tax Policy…

As the following data from the Tax Policy Center highlights, since the Carter administration in the 1970s, the income taxes paid by the wealthy as a percent of their income have increased slightly, defying some myths that Reaganomics irrevocably cut income taxes for the wealthy. In contrast, the tax burden on middle-income taxpayers has been slashed and the federal income tax code has become a significant engine for reducing poverty among the lowest-income families via the Earned Income Tax Credit and Child Tax Credit. (The collapse of corporate taxes is the real problem at the federal level, something I will write more about soon).

Despite some nostalgic mythology around 70% marginal tax rates for the wealthy in the 1970s, the tax code was so riddled with exemptions and tax shelters that Clinton’s tax increases in the 1990s not only reversed the cuts under Reagan but increased income taxes paid by the top 1% compared to under Carter. Bush Jr. reversed those increases but Obama largely restored the Clinton era rates - and Democrats blunted enough of Trump’s tax cut proposals to maintain most of the effective tax rates on the rich.

And all along the way, including the current battle to expand the Child Tax Credit, progressives fought to lower the tax burden on middle and lower-income families, which in turn helped neutralize the anti-tax rhetoric of Republicans.

Social security taxes are still a burden for working-class taxpayers, but voters understand that those taxes will be returned as a pension later in ways that reward lower-income workers disproportionately, so there is less concern by progressives and by voters themselves on those taxes than the income tax

Yes, progressives have even more ambitious goals to increase taxes on the wealthy, including having the rich pay a fairer share of social security as well as proposed wealth taxes by Warren and Sanders in the 2020 campaigns, but nationally, tax inequality has been substantially reduced in the last few decades.

…But Progressives Have Mostly Failed to Fix Tax Inequality at the State Level

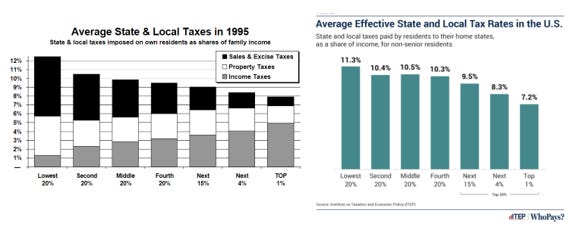

Every few years, the Institute for Taxation and Economic Policy (ITEP) produces a report on tax equity in the states called “Who Pays?” They are on their seventh edition since the first one came out in 1996, but the depressing reality is that taxes paid at each income level from that first edition are remarkably similar to the distribution in their current report (on the right below). The poorest taxpayers pay the highest percentage of their income in state and local taxes and the very rich pay the least.

The main difference since the first edition is that, on average, middle-income taxpayers are paying slightly more now as a percentage of their income in state and local taxes today and the top 1% are paying somewhat less.

If you compare state-level taxes to federal taxes (see graphs below combining data from the Tax Policy Center and ITEP), the story is one where despite all the efforts at the federal level to relieve the tax burden on low-income families, states are still helping tax the working poor further into poverty. You see that the burden of property taxes falls heaviest on the poorest taxpayers, partly through increased rents from the taxes landlords pass onto renters.

If you include social security taxes, the combined state, federal, and local taxes paid by the poorest Americans are a crushing 18% of their meager incomes. And middle-income taxpayers pay more in property taxes than they do in federal income taxes. Only wealthy taxpayers pay more in federal income taxes than they do in property taxes- highlighting why the latter has driven so much political ferment in the states.

Florida as a Tax Hellhole

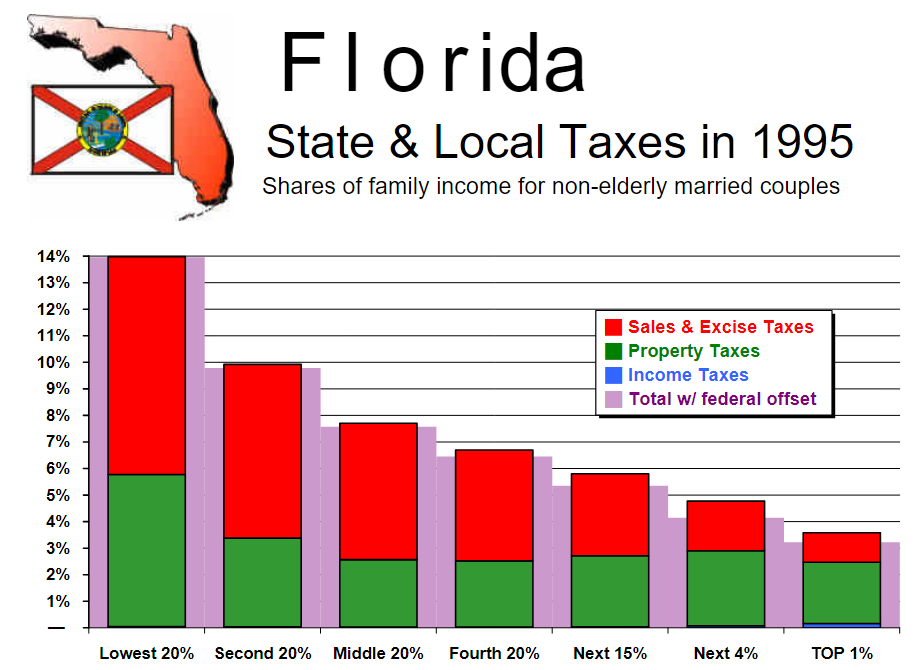

The above is bad but they are averages - and Florida is an example of the worst of the worst in tax inequality, a place where the poorest residents pay 13.2% of their income in state and local taxes, while the wealthiest citizens pay only 2.7%. With no income tax, the state has to depend on high and regressive sales and property taxes to fund all public services, with no rebates or credits for low-income taxpayers.

It is a state where tax inequality has only gotten worse. Back in 1995, middle-income residents paid only 7.7% of their income in state and local taxes, roughly 2% less than now, while the wealthy paid a bit more (3.6%). Since Republicans have run the Florida state legislature since the late 1990s, the failure of Democrats to make this an effective political attack is striking (despite occasional attempts) - but then the tax code was only marginally better back when Democrats were in control in 1995. It even taxed low-income families at higher levels than under current policy.

The failure by Democrats previously to provide even the most basic tax equity is no doubt one reason the GOP has ended up dominating Florida, despite the urban and diverse population that would more naturally put it in the Democratic column.

The Vermont Alternative

If Florida is a state that remains stubbornly Republican despite expectations otherwise, Vermont is the opposite: a largely white, largely rural state that by all demographic trends should be Republican but has voted consistently Democratic and even elected the only self-identified socialist to the U.S. Senate in our history.

It’s likely no coincidence that Vermont is ranked by ITEP as having one of the most progressive tax systems of any state, with a tax system where the wealthy pay a significantly higher percentage of their income in taxes than its poorest residents.

What’s notable is how different Vermont’s tax profile is not just from Florida but in particular from other small, largely white states to which it might be compared, like South Dakota, Wyoming, Oklahoma, and even its neighbor, New Hampshire, the most GOP-leaning of New England states. In each of these states, the lowest-income taxpayers pay a higher percentage of their income in taxes than in Vermont, and the wealthy far less.

Progressives nationally just haven’t built a narrative that “red states are high tax states for the poor and where the rich get a free ride.” Local activists in individual states have fought hard for tax fairness, but national progressives lack the focus on state politics and messaging, while conservatives build much of their national agenda on state politics and policy, whether attacking “Critical Race Theory” or denouncing “high tax blue states” Of course, those red state leaders like DeSantis mostly reference top tax rates on the wealthy in blue states while ignoring their own crushing tax rates on the poor.

How Failure to Address Property Taxes Broke the Liberal Coalition & Ushered in the New Right in the 1970s

I highlight Vermont because of its contrast with similar white, rural states and also because it is the ONLY state in the country according to ITEP data where the wealthiest 1% of residents pay a higher percentage of their income in property taxes than the bottom 20%. There are lessons in both policy and politics of a road not taken in other states that might have defused the toxic right-wing fusion of racism and antitax politics that drove the rise of the New Right in the 1970s and beyond.

As multiple writers have described, the so-called “tax revolt” of the 1970s centered on property tax battles was the proving group for much of the new populist rightwing politics. Mike Davis in his magisterial account of the development of Los Angeles, The City of Quartz, highlighted how redlining and the explosion of new suburbs led first to the emergence of many balkanized, racially-exclusive enclaves. In turn, because of limited housing in those enclaves due to exclusionary zoning, housing prices exploded along with property taxes, driving the California tax revolt.

Even as a few scattered progressive groups sought ways to protect middle-income homeowners from being drowned by escalating property taxes, the Democratic state legislature largely ignored those concerns and corporate interests coopted the movement and pushed through Prop 13, which not only limited property taxes for residential property but also limited it for commercial property. This would help gut local government finances and soon inaugurate 16 years of Republican governors in the state riding the backlash of the tax revolt.

California was a testbed for a tax revolt that would spread to other states and be a core issue and ideological touchstone for Reagan’s election in 1980. Eighteen other states would enact tax-cutting or tax-limitation initiatives in the next four years, from Massachusetts to Alaska. “The tax revolt…catalyzed the mobilization of a conservative Presidential majority,” wrote Thomas and Mary Edsall in their history of race and politics in the era in their book Chain Reaction. It in many ways broke the liberal coalition, dividing the electorate less along the older lines of workers versus corporate employers, but as taxpayers versus tax recipients, with all the racial coding the latter implied.

A Blueprint for Reforming State Taxes to Help Drive National Progressive Victories

The recent round of escalating property prices has brought a similar hike in property taxes around the nation, which is a recipe for potential new rounds of tax revolts. An analysis of U.S. Census data found that the average property tax bill rose by nearly 20% between 2016 and 2021- and that is not even as high as overall housing prices have increased, reflecting that new homeowners will face even higher taxes in many cases.

If progressives don’t take the initiative to ease the burden on fixed-income homeowners and renters, the Right will harness that discontent for rightwing antitax policies instead.

Vermont and a few similar states provide a blueprint that can be replicated and potentially shift politics away from conservative politics by rehabilitating the progressive brand in multiple states. The idea is relatively simple even if the details of the policies have their wonky complexities. Called “circuit breakers,” the idea is to ensure that property taxes are limited to no more than some basic percentage of a homeowner’s income.

17 states tie property tax payments to a percentage of income but most offer help only to the elderly or other restricted categories of homeowners.

There are a handful of states that offer significant property tax relief to all taxpayers based on their income, but none are as generous as Vermont, which provides relief checks up to $8000 for the lowest-income homeowners and up to $3000 for low-income renters.

Maine has one of the other generous property tax rebate programs, offering up to $2000 to homeowners and renters based on their income and tax burden- helping to explain why Maine is notably another white rural state that leans Democratic.

ITEP has an issue brief on Property Tax Circuit Breakers that describes more of the wonky concerns advocates should consider.

State advocates can also improve tax equity by promoting higher tax rates on luxury real estate, often called a “mansion tax.” (See this policy brief by the Center for Budget & Policy Priorities). In practice, this takes the form of higher transfer taxes when high-end properties are sold. The highest real estate transfer tax is 3.9% on New York properties worth more than $25 million and in 2019, Washington State established a top rate of 3% on property worth more than $3 million. While no state has a graduated annual property tax on residential property, D.C. has a higher tax rate on more expensive commercial and industrial property and it’s a model states might consider for residential property as well.

Getting Angry and Taking Action

In blue states, progressives should fight to improve tax equity - and every state has room for improvement, including Vermont - both because it can forestall the Right trying to make inroads on the issue and because it’s the right thing to do. And in red states, Dems should make it a political issue and slam Republicans for drowning the poor in high taxes. And in those red states with ballot initiatives, progressives should be working to bring a leftwing tax revolt to the ballot.

But what activists at the state level need is for national Democrats to make crappy state tax policy an issue. I give California Gavin Newsom credit for slamming Texas and Florida in the media for their high taxes on working families. We need more national leaders echoing Newsom and calling out Republicans for their unequal tax systems and the burdens they put on working people.

Building that kind of national narrative is the way to support local activists- and make the tax issue work for angry Democrats all over the country fighting for tax justice.