The $2 Trillion Price Tag of Mass Deportations

How the Diversion of White Collar Crime Fighting to ICE Deportations Explodes the National Debt

MAGA Republicans want to claimed the mantle of fiscal discipline. But their “MAGA budget” and focus on mass deportations will explode the debt to unimaginable levels in coming years.

By supercharging immigration enforcement, hollowing out the Internal Revenue Service, and diverting white‑collar crime investigators to chase restaurant dishwashers, the proposal would pile nearly $2 trillion additional costs onto the national debt over the next decade, all on top of the insane corporate tax giveaways already projected in the budget.

In other words, mass deportation is more than a human rights abomination—it is a fiscal catastrophe, threatening to starve Social Security of contributors, embolden tax cheats, and hobble the agencies tasked with recovering stolen public money. Below, we unpack the numbers sector by sector, show how each policy choice compounds the debt, and explain why this agenda would blow a crater in the federal balance sheet even larger than the 2017 corporate tax cuts.

A Trillion‑Dollar Shock from Deportations Alone

Let’s begin with the headline number. The most comprehensive public estimate of the GOP plan comes from the Cato Institute, a libertarian think tank not known for liberal alarmism. Cato’s economists calculate that the wild spending by ICE and related agencies trying to implement large‑scale interior enforcement—sufficient to remove the nation’s millions of undocumented residents—would cost $80 billion per year under the MAGA budget proposals and the Trump administration’s aggressive ramping up of ICE and CBP hiring.

ICE is required to hire at least 10,000 new agents, which would more than double the number of Enforcement and Removal Operations (ERO) agents. Aside from the human rights horror that unleashing that many more ICE agents on the nation will generate, as CATO notes, unless all those agents are fired immediately in 2029, this may well be locking the nation into a decade of outsized yearly spending on immigration enforcement that is not accounted for in long-term projections. Add in the costs of detention facilities - padding the profits of private prison companies who will lobby to maintain this policy - and the costs keep escalating into the future.

But the spending line is only half of the ledger. Deportations also rip productive workers out of the economy and with them the taxes they pay. Undocumented immigrants collectively contribute an estimated $31 billion a year in federal, state, and local taxes—a figure that includes payroll withholding, sales taxes, and property taxes paid indirectly through rent. Remove those workers and Treasury loses $310 billion over the decade, pushing the total cost of the mass deportations towards the trillion dollar debt increase mark.

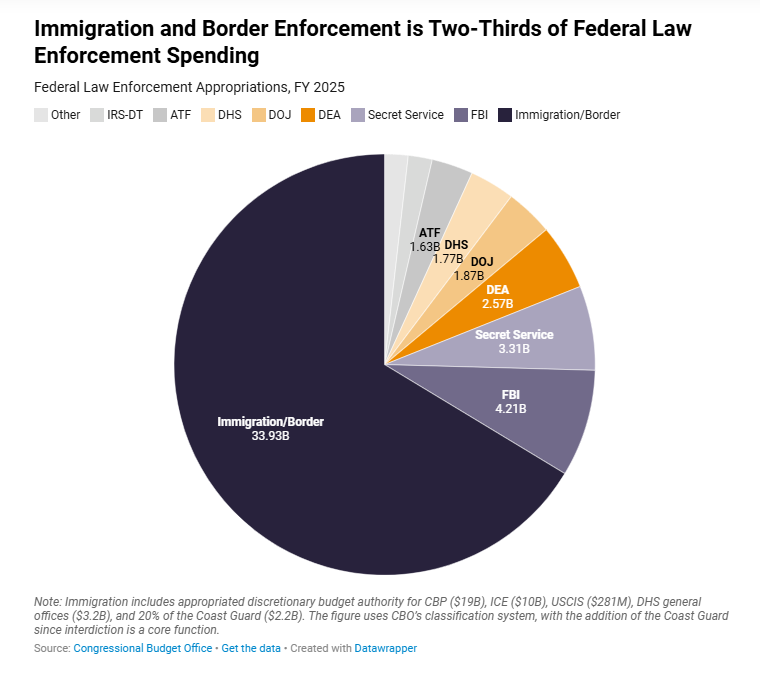

As startling as size of the these costs is the opportunity cost. Cato’s research notes that, if enacted, the United States would spend roughly thirty‑six times more on immigration enforcement than on combating tax evasion, insider trading, money laundering, and market‑rigging combined. That inversion of priorities is the fiscal equivalent of patching a drafty window while flames engulf the basement.

Social Security’s Quiet Dependence on Undocumented Workers

Beyond immediate spending, deportations sabotage America’s most popular insurance program: Social Security. over the long term. Estimates are that undocumented workers use Individual Taxpayer Identification Numbers or borrowed Social Security numbers that funnel roughly $25.7 billion a year into Social Security trust funds. Because they are ineligible to draw benefits later, their contributions act as a de‑facto subsidy for today’s retirees.

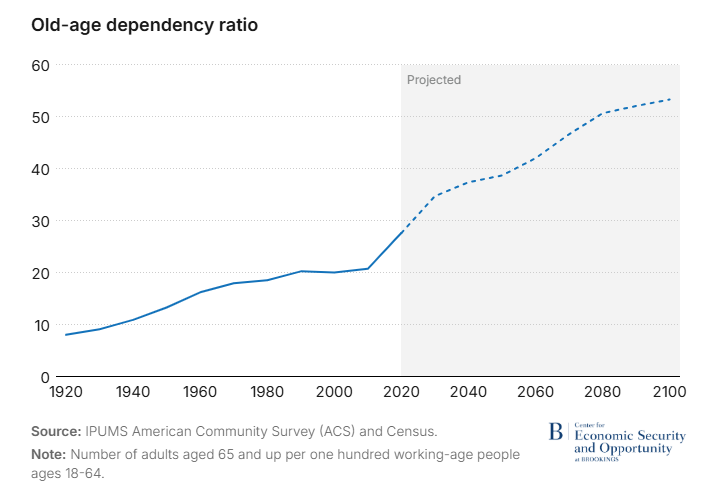

Eliminating that flow worsens the demographic crunch already facing the program, as the the Brookings Institution documents. The ratio of the elderly population compared to working adults moved from 18 retirees per working adult in 1970 up to 28 today; it is projected to rise to dramatically in coming years so by 2034, social security taxes will need to be raised to maintain current benefits. Deporting millions of prime‑age contributors will just accelerate depletion of trust funds and force tax increases on current workers to address the long‑term shortfall.

Critically, undocumented immigrants are disproportionately young and concentrated in sectors with chronic labor shortages—construction, agriculture, food service, and home health care. Purging these workers shrinks the payroll base just as Baby Boomers, and increasingly Gen Xers, are filing for benefits, forcing politicians to confront one of three unpalatable choices: raise taxes, slash benefits, or borrow even more. None of those outcomes fit the promise of fiscal stewardship.

Diverting Law‑Enforcement Firepower Away from Corporate Crime

ICE cost overruns and lost taxes paid by immigrants are only part of the story. The administration has instructed federal agencies to prioritize immigration cases, reallocating special agents and prosecutors who previously hunted Ponzi schemes, securities fraud, and corruption. According to internal FBI email summaries leaked to Reuters, at least 1,200 white‑collar investigators will be reassigned to support immigration dragnet operations in the next fiscal year.

That reassignment is not cost‑neutral. White‑collar crimes siphon more than $300 billion from households and investors annually. When fewer cases are opened, fewer ill‑gotten gains are clawed back and fewer deterrent signals are sent. The Financial Industry Regulatory Authority estimates that every major insider‑trading case deters nine future violations; dilute enforcement and you invite a resurgence in price‑rigging practices that hurt pension funds and 401(k)s alike.

The same cannibalization is underway at the tax agency. As reported by GovExec, hundreds of IRS criminal investigators and refugee‑status adjudicators will accompany ICE on workplace raids. These specialized employees are being pulled away from their statutory mission—tracing offshore shell companies, prosecuting payroll‑tax fraud, and vetting asylum claims—to serve as auxiliary deputies. Each misallocated labor‑hour is a revenue‑loss hour the government will never recoup.

How Gutting the IRS Turns Surpluses into Deficits

If deportations represent the spending side of the ledger, cuts to tax enforcement embody the revenue side. Congressional Republicans spent much of the past two years vowing to strike down the 2022 Inflation Reduction Act’s appropriation of 87,000 new IRS hires—and they have largely succeeded. Yet the Center for American Progress documented that killing IRS enforcement is one of the fastest ways to explode the debt. Every additional dollar that is not spent auditing large pass‑through businesses and high‑net‑worth taxpayers costs the government between $6 and $12 in revenue.

Last year the Treasury Inspector General for Tax Administration found that audit coverage of taxpayers earning over $5 million fell by 87 percent between 2010 and 2022. The tax gap—the difference between taxes owed and taxes collected—has ballooned to roughly $600 billion per annum. Kill the hiring surge and the IRS leaves another $200‑plus billion on the table this decade.

Worse, fewer audits embolden aggressive tax‑avoidance strategies: profit‑shifting to low‑tax jurisdictions, dubious business‑expense deductions, and private‑equity “fee waiver” maneuvers. Economists at Stanford and the University of Chicago estimate that each percentage‑point reduction in audit probability raises under‑reported income by two percent among the top 1 percent. When policymakers slash enforcement, they de facto legislate a massive, regressive tax cut for the wealthiest filers—financed by larger deficits or higher burdens on wage earners.

And the costs add almost another trillion dollars to the debt in the next decade.

Toting Up the Damage: A Two‑Trillion‑Dollar Detonation

Put the pieces together and the magnitude of self‑inflicted harm becomes clear. • Direct deportation outlays and lost tax receipts: ≈ $1 trillion over ten years. • Foregone revenue from canceled IRS enforcement surge and diminished corporate crime fines: another ≈ $1 trillion. • Knock‑on effects on Social Security, interest costs, and GDP growth: unmodeled but potentially hundreds of billions more.

These estimates track the Congressional Budget Office’s methodology for dynamic scoring but err on the side of caution. They exclude, for example, the productivity losses inherent in turning labor shortages into outright labor deserts in industries such as agriculture, seafood processing, and long‑term care. They also omit the fiscal drag caused by slower population growth—an effect that the IMF calls a ‘demographic tax’ on advanced economies.

Even under conservative assumptions, the MAGA immigration‑enforcement regime will annul every dollar of savings Republicans claimed from gutting social programs, and then some. The math is inescapable: Trump deportation cruelty costs money—lots of it.

The Fiscal Suicide of Mass Deportations

MAGA Republicans gave up any pretense of real fiscal conservatism decades ago but the current policy is verging on fiscal suicide for the nation. Spending billions to deport tax‑paying workers while handing a de facto amnesty to corporate tax cheats is political insanity driven by corporate donors crossed with racist political fearmongering.

And remember, every extra dollar of borrowing today compounds through interest. At current Treasury rates, $2 trillion in new debt will rack up roughly hundreds of billions of dollars in additional interest payments over the decade—money that could otherwise modernize ports, build affordable housing, or fund medical research. The MAGA deportation plan therefore carries an unseen ‘interest surcharge’ that future Congresses must either service with tax hikes or roll over into perpetuity. That is the hidden cost of letting political theater trump sound budgeting.