Maga Court Majority Made Clear Yesterday that They Will Likely Kill Any Tax on Billionaires' Wealth

The MAGA Court continues to be the puppets of the billionaire class that put them on the bench.

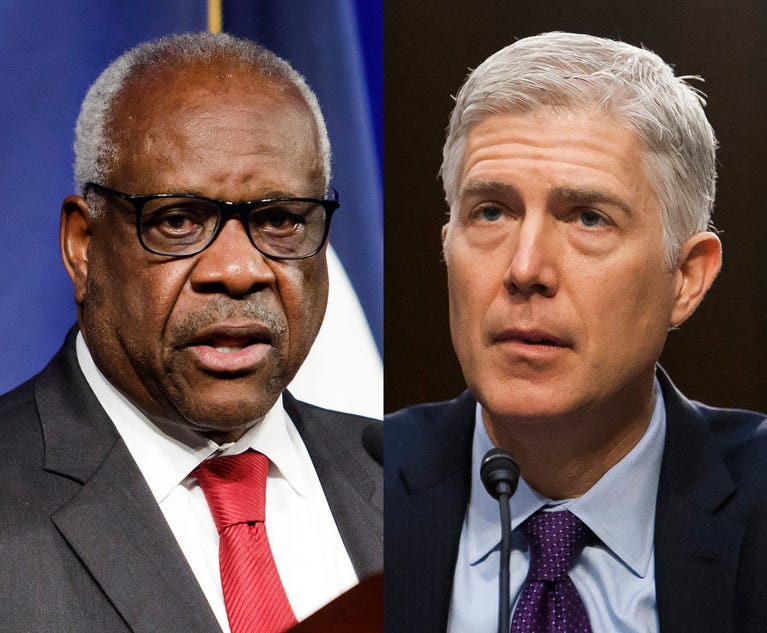

Yesterday, the Supreme Court by a 7-2 vote in Moore v. United States refused to blow up our whole corporate tax code, as the dissenters Justices Thomas and Gorsuch were quite willing to do.

However, while the Court upheld the specific 2017 tax in question, the arguments in the dissent, in a concurrence by Justices Barrett and Alito, and even in Justice Kavanaugh’s majority decision made clear that if Congress enacts an actual wealth tax or even a tax on unrealized capital gains, as Joe Biden has proposed in his recent budget proposals, the MAGA Court majority will likely strike it down as unconstitutional.

After years of buying off politicians and packing the Court, the billionaire class has bought themselves a Court that will not let voters touch their trillions of dollars in accumulated wealth. Which is absolutely the best investment those billionaires ever made.

The case decided yesterday centered on a one-time tax, called the Mandatory Repatriation Tax (MRT), which was assessed on American shareholders based on assigning them tax based on income earned by American-controlled foreign corporations. While details differ, in many ways, as Kavanaugh wrote for the majority, “the MRT operates in the same basic way as Congress’s longstanding taxation of partnerships, S corporations, and subpart F income,” where those entities’ income is attributed to their partners and shareholders and taxed accordingly on individual tax returns.

If that was all that was debated in the case, this would have been a boring, inconsequential tax case. However, the real debate was where the Court is going to draw the line on assigning taxes to shareholders - and whether a wealth tax or a tax on unrealized capital gains will be upheld if it comes before the MAGA Court.

Counting to Five on Striking Down a Tax on Unrealized Capital Gains

The dissenters Thomas and Gorsuch were clear that they would kill any wealth tax or any tax on shareholders based on the increase in the value of a corporation - what is called unrealized capital gains.

The Biden Justice Department had argued that the Court, following the argument made by the 9th Circuit below upholding the MRT, should declare that the transfer of money directly to shareholders, so-called realization, is irrelevant to whether that increase in value can be taxed. Thomas and Alito instead argued:

“Income” in the Sixteenth Amendment refers only to income realized by the taxpayer. The Amendment resolved a long-running conflict over the scope of the Federal Government’s taxing power. It paved the way for a federal income tax by creating a new constitutional distinction between “income” and the “source” from which that income is “derived.” Drawing that distinction necessitates a realization requirement.

While Barrett and Alito joined the majority in upholding the specific MRT tax, they did so only because they argued in a very technical way, the foreign corporation involved in this case had earned actual income to be taxed.

They ruled that the income could be attributed to the plaintiff-shareholder because, as Kavanaugh had argued in the majority decision, it resembled in many ways less a legally independent corporation completely separate from the plaintiff and was more like the partnerships and LLCs that courts had treated as in practice a projection of the shareholders’ interests. But they made clear that in any new case, they would strike down any general tax on unrealized capital gains. Quoting Thomas’s dissent approvingly, Barrett and Alito argued:

The Sixteenth Amendment’s reference to income “derived” from any source encompasses a requirement that income, to be taxed without apportionment, must be realized. See post, at 23–25 (THOMAS, J., dissenting). While the Government stresses that the Amendment did not include a “realization” requirement, “realize” and “derive” have long referred to the same concept…The “commonly understood meaning of the term” income when the Sixteenth Amendment was ratified requires that a gain be “realized” or “derived”—e.g., through a sale or other transaction—to be taxed without apportionment.

So that’s four votes to strike down any wealth tax or tax on unrealized capital gains on public corporations which do not resemble partnerships or LLCs.

So what of Kavanaugh and Roberts who joined the majority decision? Where will they land on whether to strike down a tax on unrealized capital gains as unconstitutional?

Jackson Rips Apart Thomas’s Dissent - and Implicitly Kavanaugh’s Narrow Majority Decision

In a concurrence, Justice Ketanji Brown Jackson politely but thoroughly eviscerated Kavanaugh for trying to sidestep the core issue of whether Congress or the Court has the power to decide what is income under the 16th Amendment.

Jackson opens her opinion, writing:

Our Constitution grants Congress “plenary power” over taxation…During the century after our Nation’s founding, the Court repeatedly recognized that, in matters of tax policy, Congress’s view was controlling.

The Congress had passed an income tax to fund the Civil War and the Court did not interfere, but as Jackson writes, in 1895, the radical Robber Baron era Court suddenly jumped in and struck down the federal income tax decades after its first enactment in the Pollock v. Farmers’ Loan & Trust Co. decision. At the time, the decision of the Court was reviled with even President Taft, himself later a Chief Justice, arguing the decision second-guessing the power of Congress on taxation had badly “injured the prestige of the Supreme Court.” The Sixteenth Amendment was soon enacted to roll back this arrogant power grab by the Supreme Court.

Jackson then mocks Thomas’ dissent for his demand that income be “realized” before being taxed, since the “alleged requirement appears nowhere in the text of the Sixteenth Amendment.” So much for conservatives’ vaunted demand for textual support for court action. Jackson then rips into the dissent for ignoring the original intent of the drafters of the 16th Amendment, since, citing to history provided by a number of amici tax historians in the case, she notes that at the time the Amendment was drafted "income” was" “was widely recognized as flexible enough to include both realized and unrealized gains.” She mocks Thomas’ dissent for citing not the original meaning of “income” at the time but only a later 1920 Supreme Court case - which itself has been disputed by other courts. Notably, while Thomas wrote for pages on how the colonial era discussed “direct” versus “indirect” taxes, he cited essentially nothing on what the drafters of the 16th Amendment considered “income.”

But rather than just try to parse the language of the 16th Amendment, since she no doubt recognized the futility of winning over the four Justices committed to blocking taxes on unrealized gains, Jackson finishes her opinion with a broader statement demanding more humility from the Court - clearly aimed at Kavanaugh and Roberts.

I have no doubt that future Congresses will pass, and future Presidents will sign, taxes that outrage one group or another—taxes that strike some as demanding too much, others as asking too little. There may even be impositions that, as a matter of policy, all can agree are wrongheaded.

She then cites to Justice John Marshall Harlan, who had dissented from the original case that struck down the income tax:

However, Pollock teaches us that this Court’s role in such disputes should be limited. “[T]he remedy for such abuses is to be found at the ballot-box, and in a wholesome public opinion which the representatives of the people will not long, if at all, disregard, and not in the disregard by the judiciary of powers that have been committed to another branch of the government.” Pollock, 158 U. S., at 680 (Har- lan, J., dissenting)

The problem is that Kavanaugh had no humility in his decision. He in fact at the end of his opinion lectures the Congress not to assume the Court won’t strike down a tax on unrealized gains:

nothing in this opinion should be read to authorize any hypothetical congressional effort to tax both an entity and its shareholders or partners on the same undistributed income realized by the entity.

And Kavanaugh declares that it is the Supreme Court, not Congress, that will have the final word on tax policy: “Those are potential issues for another day, and we do not address or resolve any of those issues here.”

Why This Tax Battle Matters So Much in Fighting Economic Inequality

Here is why the MAGA Justices - or rather their billionaire puppet masters - are so dead-set against a tax on unrealized capital gains.

While the reason for rightwing opposition to a straight-up wealth tax is obvious, having to wait to tax capital gains until the stock is sold may seem like an escoteric problem, a bit of a pain for the government to have to wait for its share, but not such a big deal.

But here’s the thing. Unrealized capital gains are often NEVER realized, especially among the ultrarich. First, there is NO capital gains tax on any unsold assets passed on to heirs at death; the heirs only get taxed on gains that happen after that point with a rule called “stepped up basis.” But the ultrarich largely bypass even the estate tax at death through complex trusts, which let’s them pass on assets tax-free to heirs, as this report by ProPublica documents.

A telling example of the manipulation used to avoid ever getting taxed on capital gains is the recent decision by billionaire Barre Seid to donate an entire company he owned to a nonprofit controlled by Federal Society godfather Leonard Leo. This means that all of the appreciation in value of the company for its whole history will go untaxed. Leo has amassed something on the order of $1.6 billion in untaxed donations from billionaire patrons - all to assist Leo in packing the Court with MAGA Jstices and helping ensure those billionaires will not pay any tax on the rest of their vast fortunes.

So if unrealized gains go untaxed today, most of those gains will never be taxed.

And the dollars involved are massive. The Institute for Taxations and Economic Policy (ITEP) estimates that there is $18.5 trillion in unrealized gains among those with $10 million in wealth and above. Since unrealized capital gains among the ultrawealthy constitute an estimated 43 percent of their total wealth, taxing those unrealized gains would yield tax revenue comparable to a wealth tax.

That $18.5 trillion in unrealized capital gains is enough to fund social needs for years to come while reducing the tax burden on everyone else.

The debate in Moore v. United States is about whether the MAGA Court majority will undemocratically use their power to deny the elected branches the power to touch that wealth through our tax system.